Here at KBL Accounts we work with a number of agency workers - particularly nurses - who are concerned about how to handle HMRC when declaring earnings above and beyond any permanent employment.

When they first come to us, they are generally working under an umbrella company which pays them PAYE or they declare their extra earnings on a self-assessment tax return each year.

But with our help they have gone on to set up their own limited company - making the most of their money.

How do you do it?

Forming a limited company is far more straightforward than you may think and is usually completed the same day, within a few working hours.

We can remove all the headache of admin to make the whole process even easier, supplying you with a brief questionnaire asking you to choose a company name and provide some security information.

We can then register you with Companies House, handling all the administration responsibilities this involves.

How does it help?

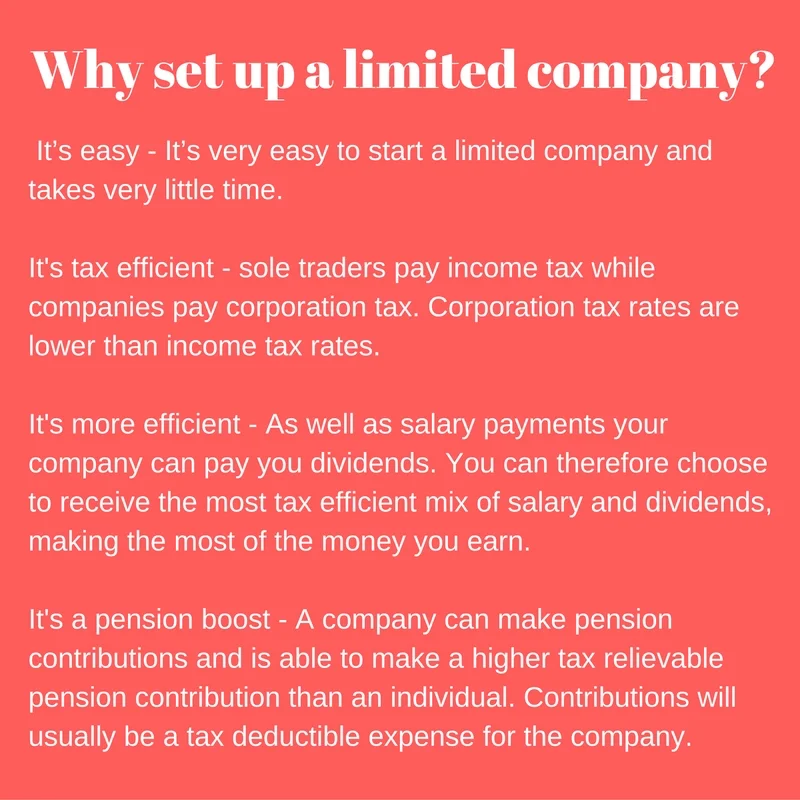

Any accountant will tell you that working through a limited company is the most tax efficient way to operate as it allows greater opportunities for tax planning.

These include allowing you to deduct certain business expenses including mileage and subsistence.

Of course limited company ownership does come with some administration responsibilities such as keeping accurate company accounts – and you still need to pay tax on your profits – but we can manage deadlines and paperwork on your behalf.

Why choose us?

For anyone who is considering leaving the world of permanent work and becoming an agency nurse, having an experienced and qualified accountant to help you keep your finance in order is hugely helpful.

It is also a benefit to any nurse who uses agency shifts to top up their income from full-time NHS employment.

As a firm, we specialise in the contractor market, helping contractors, freelancers and independent professionals to maximise their income.

We provide an all-inclusive, accountancy package which takes care of all your business and personal taxation needs. This service also includes unlimited access to your own dedicated accountant, free face-to-face meetings and help dealing with HMRC.

For more information, give us a call today.