An invoice is a document you prepare for a customer asking for payment for work completed. It's something businesses need to stay on top of. After all, preparing and issuing an invoice promptly, gives you the best chance of being paid earlier.

It’s important to include all necessary information on an invoice.

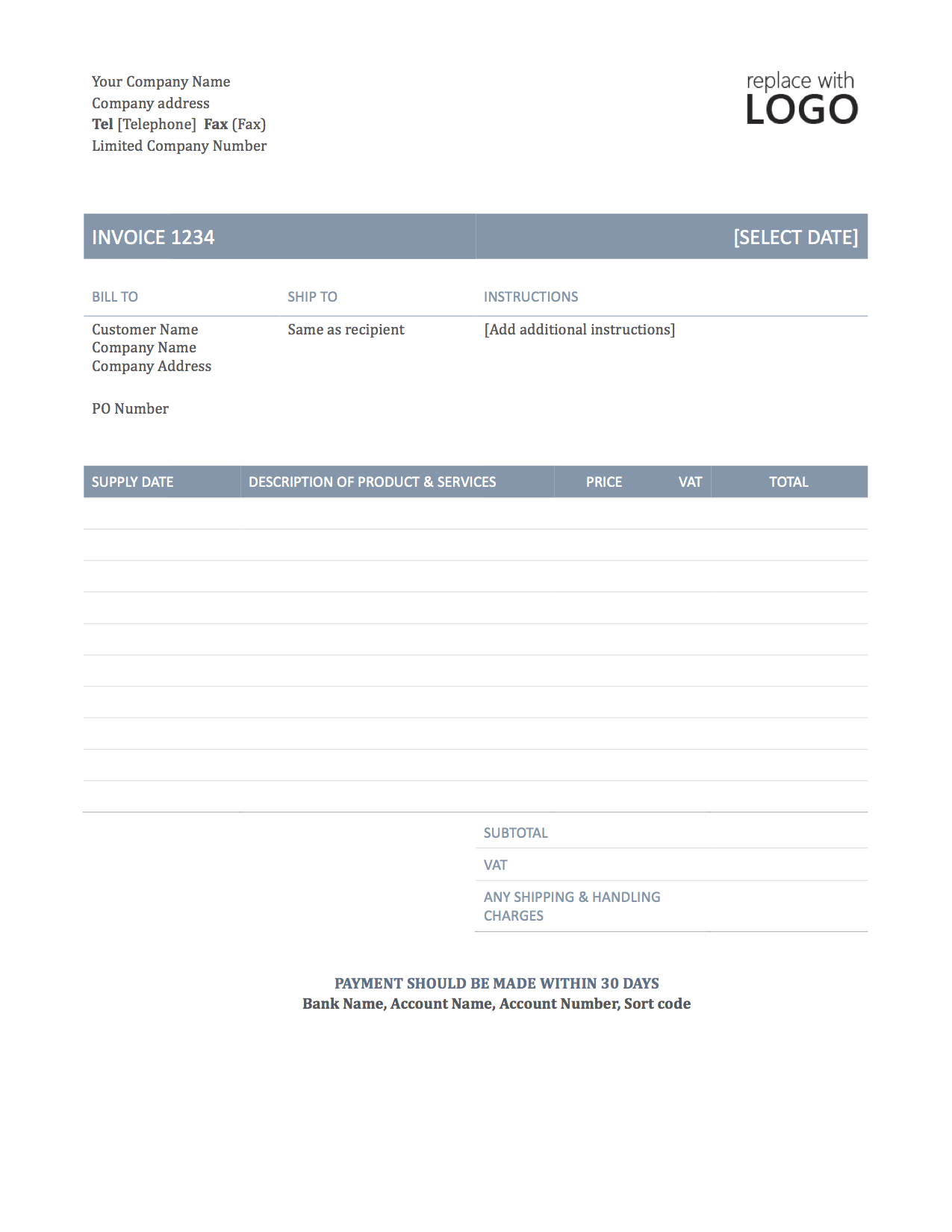

Firstly, make sure that all your invoices are clearly marked with the word ‘invoice’. This makes it clear to the customer that it’s a request for payment rather than a receipt.

You should also include:

1. The name and address of your business. It’s helpful to include your contact details too, including a phone number and email address.

2. Your limited company information. If you’re a limited company, you’ll need to include your registered office address as well as your company registration number. You’ll need to show the formal registered name of the company, alongside any name which you’re using to trade.

3. The name and address of the company you’re invoicing. A contact name will help your invoice reach the right person.

4. An invoice reference or invoice number. Lots of people get confused about this but it doesn't need to be complicated. All you need to remember is that your invoice number or reference should be unique to this invoice. Some people choose to invoice in sequence to help this - 1,2,3,4 etc... Others choose to include some letters too. So, if you client was Poppy Nursing, you might reference it PN1, PN2, PN3 etc... Many people put a few zeros in front of early invoice numbers so that they’ll all be the same length and easy to sort – so starting at, say, 0001 rather than just 1. Make sure you keep a record of the numbers or references so that you don’t accidentally duplicate one.

5.The date the goods or services were provided. This is important for VAT invoices and is often known as the “supply date”.

6. A date for the invoice. This will generally be the date on which the invoice is created, not necessarily the date the goods or services covered by the invoices were provided.

7. Details of the products or services provided and their cost. You need to provide a clear description of what you’re invoicing for. This prevents a customer needing to contact you to query the invoice. You might want to include details like day rates, hourly rates, time taken, work done and you should also include a total amount for the invoice.

8. Payment terms for the invoice. This details how long the customer has to pay. For example, it will say: “Payment should be made within 30 days”.

9. Details on how to pay the invoice. It’s in your interests to make it easy for customers to pay you so include payment methods you’ll accept and your account details if you allow BACS/direct payments. This will consist of your bank name, account name and number and sort code.

If you ask for payment by cheque, provide a payee name.

10. The customer’s purchase order number (if available)

Sometimes you customer will provide you with a PO number. If they do, include it in the invoice.

What about VAT invoices?

If you’re VAT registered, there’s further information you’ll need to include. Further information on this is available on the HMRC website but in short, this should include your VAT Registration Number and either:

- The VAT rate and total amount of VAT charged (if all products and services are subject to VAT at the same rate); or, if not

- The amount of VAT and VAT rate charged on each item.

While many businesses will submit a hard copy invoice by post, you could instead choose to send the invoice by email. It may help to speed things up, although if you do so it’s best practice the convert the invoice to a PDF document so that the customer is unable to alter it.

Please take a look at our template below. If you would like some more help with your invoicing and bookkeeping, contact us today.